Last week the National Association of Realtors announced it settled a lawsuit alleging a monopoly on how broker fees are charged. The result was agreeing to pay $418 million in damages.

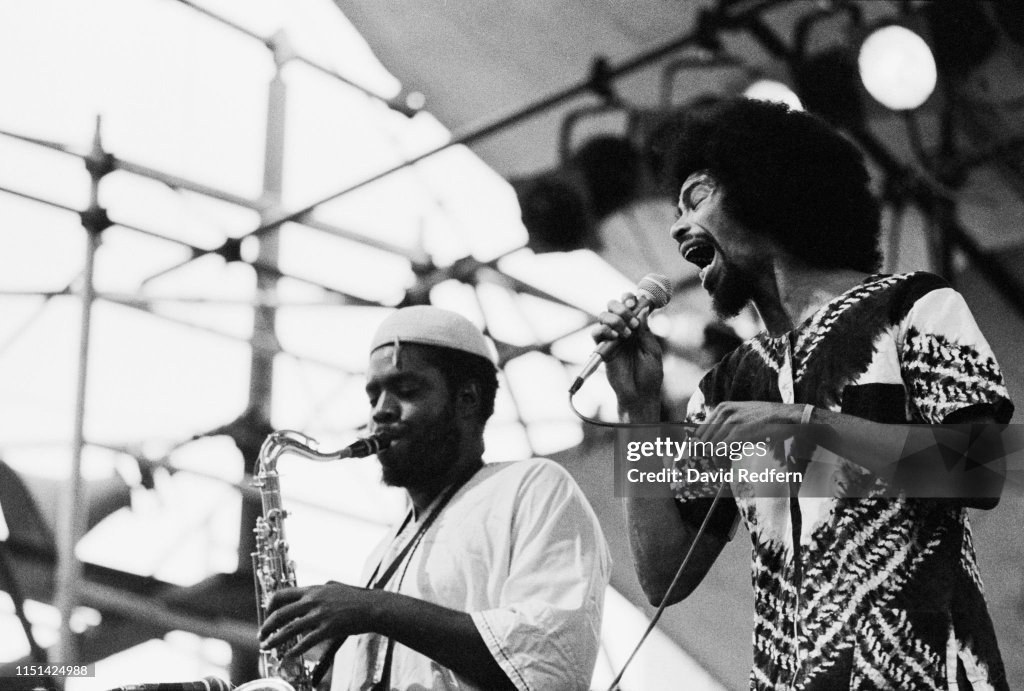

Home ownership is the largest investment most of us make and in a consumer economy the impact could be enormous. From the lyrics of one of the hits from the late bluesologist Gil Scott-Heron, “all of us are consumers.”

Education is everything.

Buying or selling a house seems like a basic proposition. However, behind the scenes there are many moving parts and treacherous roads which is why the typical broker fee of six percent has been an acceptable practice. Of course, many states allow the buyer to sell their home on their own. That is great news but there are many technical nuances which is why most simply agree to hire a broker and leave the responsibility to them.

The seller of the property pays the broker fee thus even though you may have two brokers on a transaction; one called the listing broker (the broker who represents the seller) and the other is called the selling broker (the broker who brings the seller into the transaction), it is the seller who pays both fees. The result is sellers could achieve “free” representation in negotiating to buy the property. Some call it the “fox in the henhouse” but that is a stretch as while both brokers represent the person who pays the commission (THE SELLER), they are bound by a code of ethics which leads to a successful transaction.

One critical component of broker’s justifying the six percent was the ability to market the property. Typically, this was done using a Multiple Listing Service which allowed properties to be listed or made available to the thousands of other brokers who were part of the service. The result was a quicker and more reliable sell.

Over the years technology has improved and technical information which buyers and sellers did not have access to is now readily available. This is great news, but many went along with past practices simply because the brokers’ commission was tucked into the sales prices and the overall market determined what was a fair price. It was akin to “no harm, no foul.”

It is one thing to have information and it is another to know what to do with it. So, while sellers could effectively sell their property for zero commission or even hire those brokers offering commissions as low as one percent, it boils down to how long will it take to sell the property via marketing? At the same time, as mentioned, a real estate transaction has legal components and accepting the risk is an individual matter. Some are willing to take the risk and some, even though the savings may appear beneficial, are not willing to take it.

The bottom-line

So, while sellers always had the ability to achieve a lower commission structure, only time will tell what the overall benefit consumers will receive. Will it result in lower home prices? Will brokers suddenly exit the business? Will the marketing of properties be negatively impacted?