If you are trying to buy a home; First-Timer or otherwise and have 20% down and are otherwise receiving assistance (parent, relative, employer, etc.) this article is not for you. However, if you are one of the millions who struggle with the notion or question if you will ever be able to purchase a home, this article may provide the inspiration you have been waiting for.

The news is the news, and most traditional sources speak to the high cost of buying a home and the difficulty in ever being able to cross the finish line. Prices are sky high, interest rates are high, the accumulated cost of the mortgage is enough for even the most stealth person to simply give up. All we hear is the average cost of home ownership, which is high based on the average but that is just one reality, leaving many to scratch their heads, wondering with all the news how in the heck are people buying homes?

NOW IS THE TIME

Even though I am retired, my Broker’s License remains active so on occasions I get calls from past clients or referrals seeking advice on home ownership, mortgages, and the like. My advice is simple and holds true from all the years I was active – Prices are relative. Some seem to think “yesterday’s prices were so great or so affordable.” That may be true but try telling that to someone who purchased during those times. It has always been a struggle, although admittedly, today’s struggle requires more determination.

DO YOU THINK PRICING IS OUT OF YOUR RANGE? ARE YOU WAITING FOR PRICES TO GO DOWN? ARE YOU WAITING FOR INTEREST RATES TO GO DOWN? ARE YOU HOPING TO WIN THE LOTTERY? ARE YOU WAITING FOR AN INHEIRANTENCE? – Assuming you are qualified and truly want to experience home ownership…… NOW IS THE TIME!!!!!!

Here are some basic tips to help those serious about home ownership.

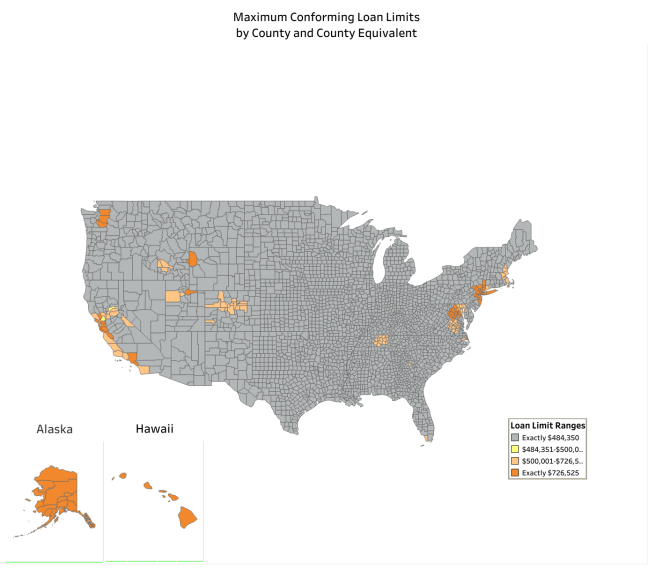

- Get Qualified. Know how much you can afford. There are many direct lenders, including those online as well as certified mortgage brokers who can provide a legitime approval letter. Remember home ownership is basic. For most, the two biggest hurdles are down payment and creditworthiness. Again, you do not necessarily need 20% or have perfect credit. Even in today’s higher priced environment, there are plenty of low-down financing options. For those lucky enough to have served in the military and have an active DD214, VA loans are available with ZERO DOWN and no maximum loan amount (of course the trade-off may be a higher monthly mortgage payment but the windfall is not having to pay hard cash towards the down payment).

- Know your budget. You may be qualified for a mortgage payment of say $5,000 per month BUT your comfort level may be $2,500 per month. Stay within your comfort zone.

- Match your qualification with a property. This can be tricky as even though you may be qualified for more, the lower priced property may seem undesirable but do not look a “gift-horse” in the mouth. The key is to stay within properties of your comfort zone. Again, if not now, when?

- Broaden your net. MOST IMPORTANT. Like any good fisherman, the wider your net (of information) the more likely you will find success.

- Staging, Keep moving. Staging is great because many want a property that is turn-key or providing a vision of what the home might look like. Who would not want all the modern furnishing, luxury appliances, fashionable interior appointments, etc.? That may not be your target because most properties that are staged are at the high-end of the market. Move on. Look for something that removes the impulse of all the whistle and belles and instead focuses on getting in or affordability.

- The sign in the front yard. Data is real but just remember while the majority who purchase a home might very well purchase where there is a “For-Sale” sign in the front yard, there are many more than you might imagine who purchase a home where there is not a for-sale sign. Yes, it is the needle in the haystack, but you must think out of the box.

- The average is the average. Yes, the average home price might be $400,000 but that does not mean you can’t find anything lower. Like any commodity, the property may have issues or other factors resulting in lower prices. Again, the goal is not to find the crown jewel, already furnished property, ready to move-in….it is to find a property you can afford.

- Network and broaden your sources. Everybody does not need to know about your business BUT let those you trust know (family, friends, colleagues, church members, social groups, etc.) you are seeking to purchase a home.

- Distressed properties. This is not for everybody but there are homes to be had from those who may be having financial distress or even institutional sources that offer Real Estate Owned (foreclosures) from their inventory – FHA, VA, Freddie Mac, Fannie Mae, etc. Again, the inventory may be thin, but this is part of broadening your net/reach. You just never know where YOUR deal will come from.

- Rent to Buy. This can also be tricky, but it does represent another legitimate way to obtain home ownership.

- The Neighborhood. “I don’t care if someone gave me the property, there is no way I am going to live in that neighborhood.” That is a real sentiment but remember, a neighborhood is what you make it!!! Now, that is not to dismiss real negatives which may exist but just remember, there are trade-offs to everything. If you can get your price, that may be motivation to reconsider the hesitancy.

What I have communicated is not catch-all or meant for every situation. It merely represents some basic tips and ideas to encourage you to think out of the box. Also, just remember, we have not even mentioned the lender incentives but there are enough programs in the marketplace to choke a horse – you simply must be aggressive enough to seek them out and figure how they can apply to your situation.